The ongoing trade war between the United States and China shows no signs of slowing down, with tensions escalating further as U.S. President Donald Trump threatens to nearly double tariffs on Chinese imports. This could lead to a staggering 104% tariff on most Chinese goods, including smartphones, computers, toys, and lithium-ion batteries. As a result, the conflict between the world’s two largest economies is creating a volatile environment for global markets, with few signs of reconciliation in the near future.

China, which has already retaliated with a 34% tariff on U.S. goods, is bracing for the additional U.S. tariffs, with experts predicting significant economic consequences for both nations. The looming deadline, with additional tariffs set to be introduced on Wednesday, leaves businesses and governments scrambling to prepare for a more challenging global economic environment. As the two sides stand at an impasse, the question arises: who will blink first?

The Stalemate: A Long-Term Economic Challenge

“It would be a mistake to think that China will back off and remove tariffs unilaterally,” says Alfredo Montufar-Helu, a senior advisor at The Conference Board. “Not only would it make China look weak, but it would also give leverage to the U.S. to ask for more. We’ve now reached an impasse that will likely lead to long-term economic pain.”

The global markets have been shaken since the introduction of Trump’s tariffs on a variety of countries, with Asian stocks experiencing their worst drop in decades. However, the markets have seen a slight recovery as Trump’s stance on tariffs remains firm. As tensions escalate, global investors remain uncertain about the potential for more tariffs, particularly on key sectors like electronics, machinery, and industrial equipment.

This escalating trade war is part of a broader trend of growing market instability. As we saw in the previous article, “Stock Market Roller Coaster: Analyzing Recent Trends and Global Impacts,” global stock markets have been under significant pressure due to these geopolitical issues. The article offers valuable insights into the broader economic implications of the trade war, helping investors understand the intricate dynamics at play.

For a deeper dive into how these geopolitical tensions are impacting markets, read Stock Market Roller Coaster: Analyzing Recent Trends and Global Impacts.

China’s Strategy: Retaliation and Currency Manipulation

In response to the escalating tariffs, China has not only imposed retaliatory taxes on U.S. imports but has also engaged in more strategic measures. The Chinese government has allowed its currency, the yuan, to depreciate, making Chinese exports more attractive. Additionally, Chinese state-linked enterprises have begun buying stocks, possibly in an attempt to stabilize the domestic market amidst growing uncertainty.

Despite facing a slowing economy, China is seemingly willing to endure the economic pain, hoping to avoid capitulating to what it perceives as U.S. aggression. This resolve may be further solidified by a series of internal challenges, such as a property market crisis and rising unemployment. As Andrew Collier, Senior Fellow at the Mossavar-Rahmani Center for Business and Government, explains, the tariffs exacerbate these internal problems, particularly in the export sector, which has long been a key driver of China’s rapid economic growth.

If China’s exports to the U.S. are significantly reduced, the effects will be felt domestically. With exports as a vital revenue stream, China will have to rely on internal consumption and tech manufacturing to boost economic growth, which presents its own set of challenges.

The Ripple Effect on Global Markets

The consequences of these tariffs are not limited to just the U.S. and China. The impact of the trade war ripples across the globe, affecting economies in Asia and Europe. Countries like Vietnam and Cambodia, which also rely heavily on Chinese exports, will see tariffs increase drastically. For instance, tariffs on Chinese goods will rise to 54%, while those targeting Vietnam and Cambodia will soar to 46% and 49%, respectively.

Deborah Elms, Head of Trade Policy at the Hinrich Foundation, points out that the global economic landscape is shifting rapidly. “You can only tariff so much for so long. But there are other ways both countries can hit each other. It’s not just about physical goods—there are plenty of economic levers left to pull.”

Countries that have relied on Chinese exports to the U.S. will need to diversify their markets or face economic hardship. As the trade war intensifies, there is growing uncertainty about where these products will go next, and which markets will bear the brunt of the fallout.

The Future of U.S.-China Trade: What’s Next?

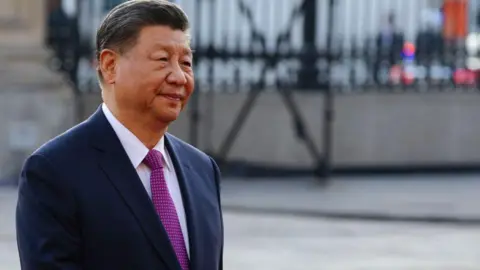

Despite the increasing tariffs, there is still room for potential negotiations. While Trump has yet to speak with Chinese President Xi Jinping since returning to the White House, China has signaled its willingness to engage in private talks. However, some experts, like Mary Lovely from the Peterson Institute, argue that the current trajectory of the trade war has become a “game of who can bear more pain,” suggesting that both sides are entrenched and unwilling to back down.

“The U.S. is overplaying its hand,” says Elms. “Trump believes the U.S. market is so lucrative that China will eventually bend, but this may not be the case. The speed and escalation of these measures are concerning, and we are entering a much more challenging phase.”

China has a range of retaliatory options, from further depreciating its currency to restricting U.S. firms operating in the country. However, it remains unclear how far Beijing is willing to go before reaching a breaking point.

Conclusion: High Stakes Ahead

The trade war between the U.S. and China has become a defining issue for the global economy, and the stakes are incredibly high. As we’ve discussed, the economic pain is expected to continue for both nations, with long-term consequences for global markets. Investors, governments, and businesses must prepare for a much more unpredictable future, and there is no clear end in sight.

For those looking to understand the broader implications of these trade dynamics on stock markets and global economic trends, be sure to check out Hush Money Scandals: Ethical and Legal Perspectives and Trump Backs Remote Voting for New Parents, Sparking Rift Within GOP. These articles provide additional context and insight into how political events are shaping the world of finance.

As the trade war continues to unfold, the world will be watching closely to see who will blink first—and how far both countries are willing to go in this high-stakes economic standoff.